Raise millions for your startup

We wrote the ultimate fundraising guide to help first-time founders raise millions of dollars. And it’s 100% free.

Raise millions for your startup

We wrote the ultimate fundraising guide to help first-time founders raise millions of dollars. And it’s 100% free.

Great founders can look like anyone and come from anywhere

But you might be missing the tactical knowledge to build an investor network and raise money

This book will teach you everything you need to know to fundraise from the pre-seed stage all the way to your Series A. Seriously, this guide will cover everything you need.

You’ll also get resources like email scripts, investor CRM and newsletter templates, and an investment checklist.

We hope you find value in this book. And when you're ready, share your pitch with us at Hustle Fund. We'd be honored to have the chance to work with you.

Get the book (it's free)

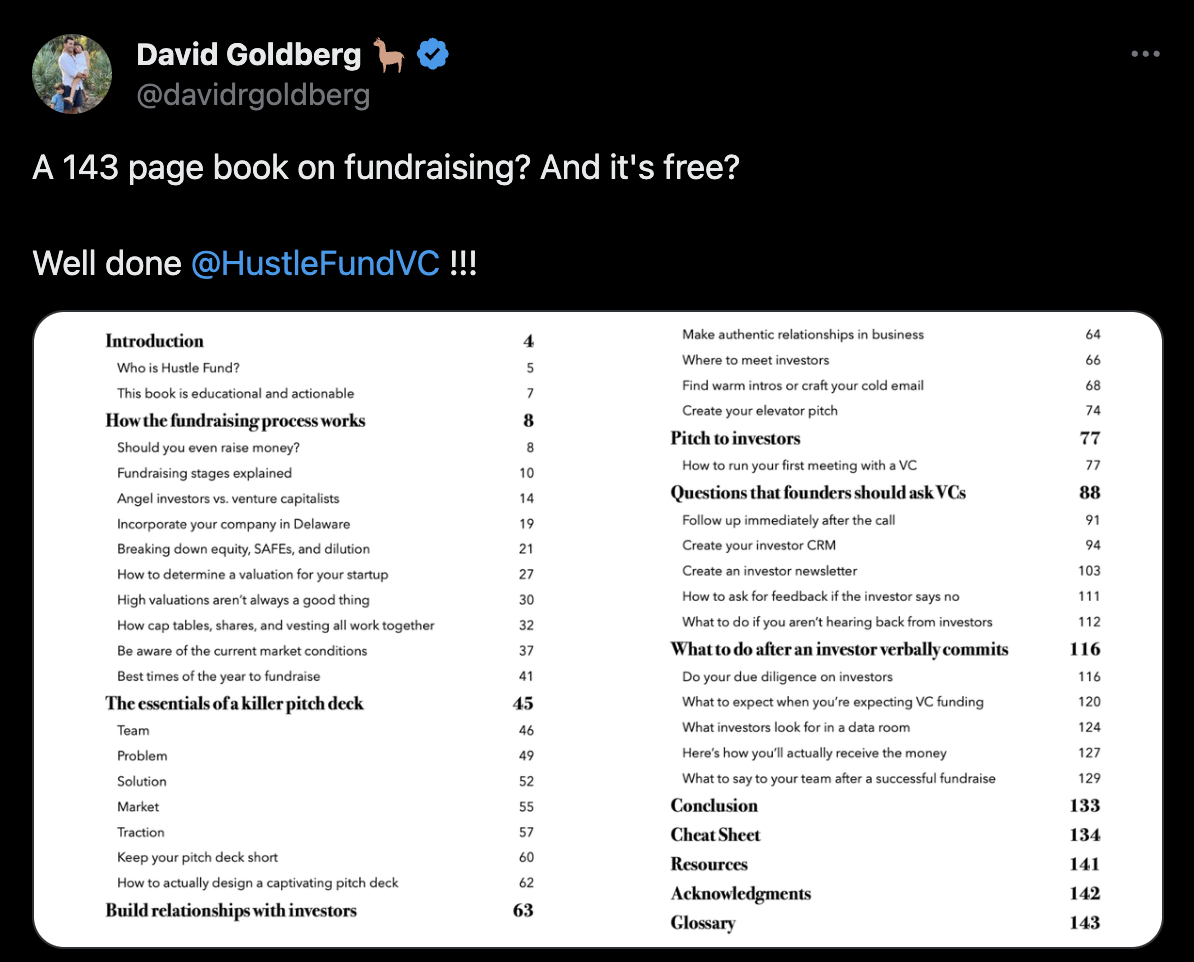

What's in the book

This free ebook will give you everything you need to know to raise your next investment round.

We break the book down into 5 chapters

Chapter 1

how the fundraising process actually works

Chapter 2

the essential ingredients of a killer pitch deck

Chapter 3

building relationships with investors

Chapter 4

how to pitch to investors

Chapter 5

steps to take once an investor verbally commits

Bonus resources

email scripts, templates, and a cheat sheet of our entire book

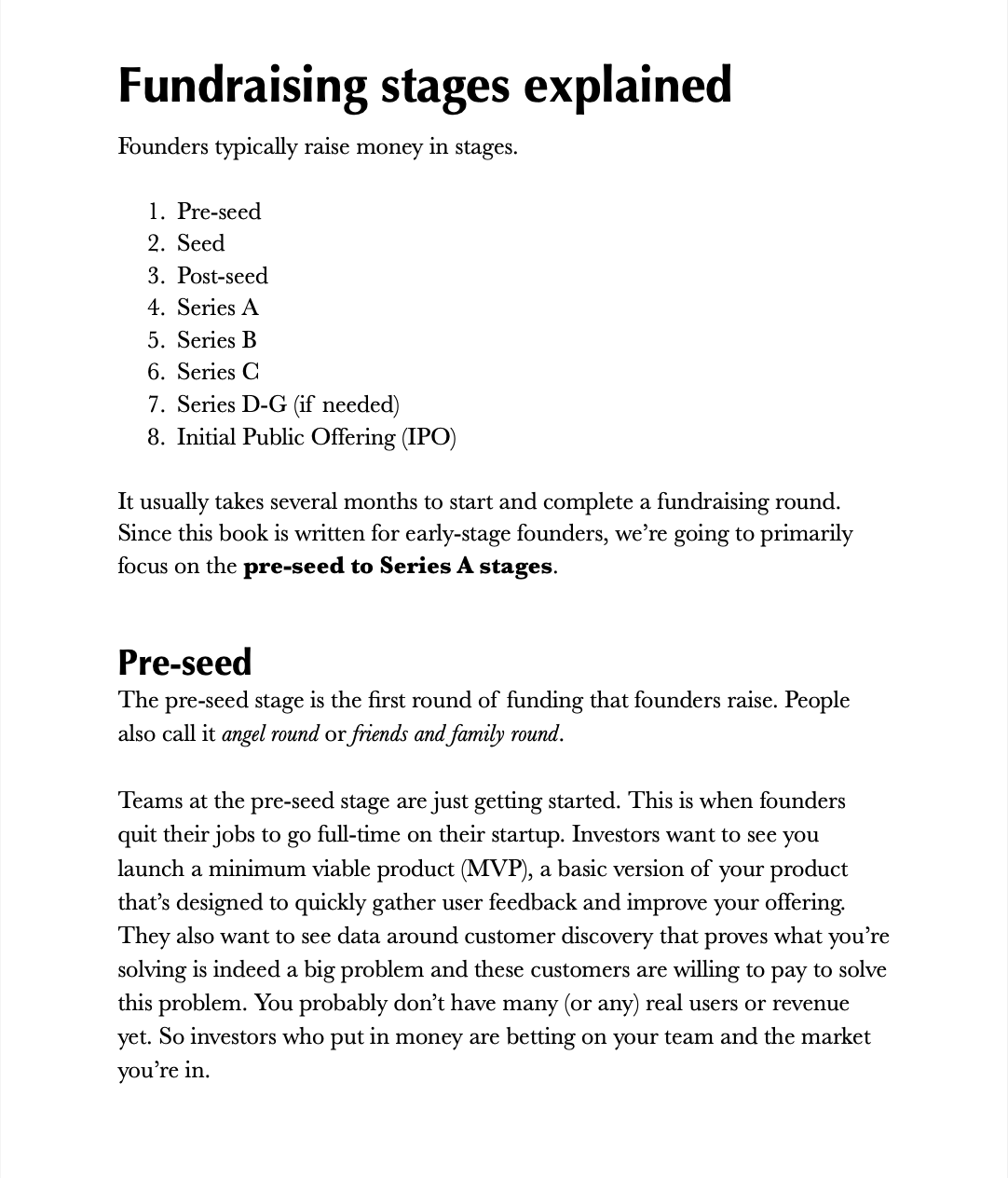

The foundations of fundraising

We break down fundraising stages, equity, dilution, SAFEs, cap tables, vesting, shares, valuations, and more.

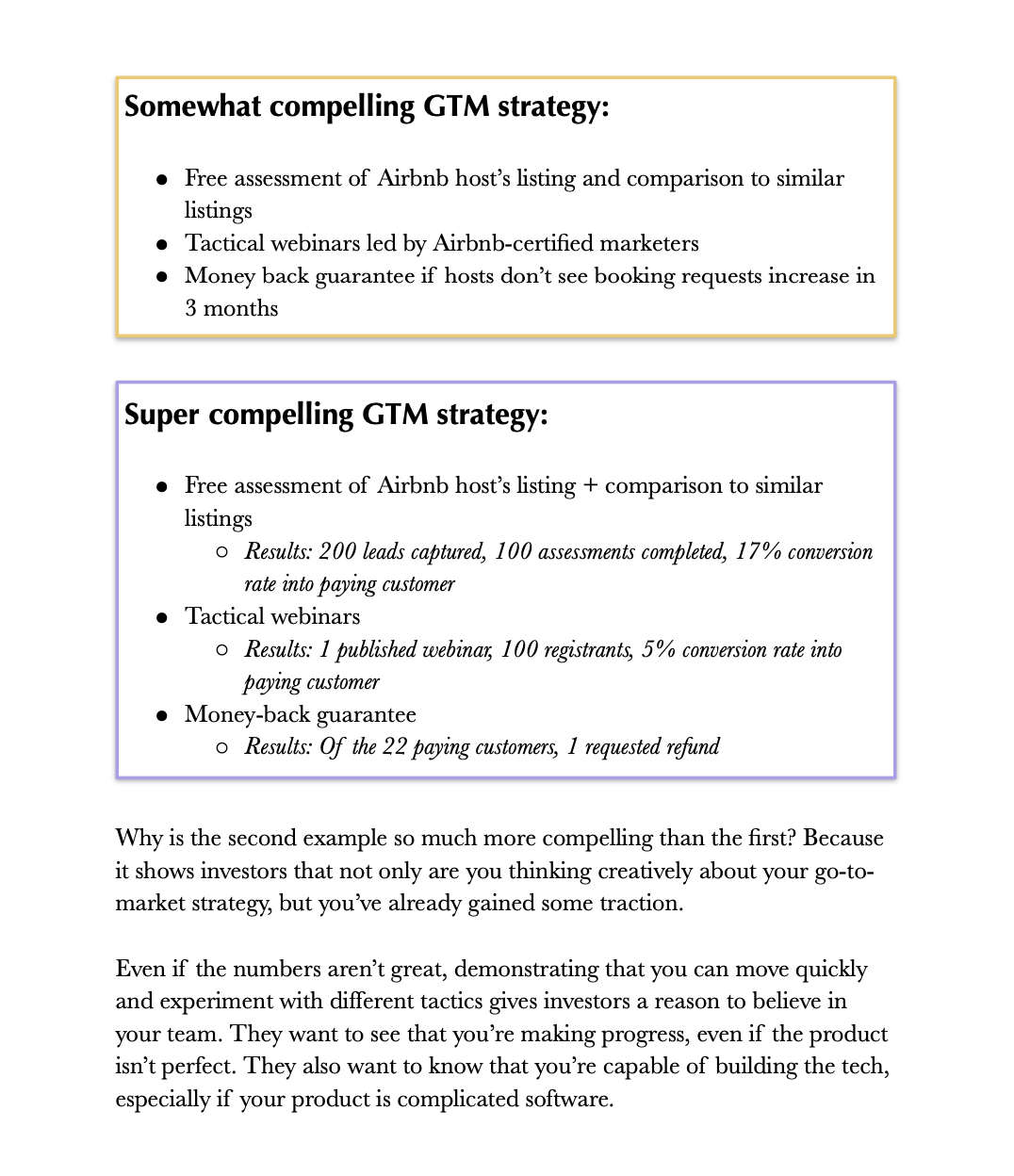

Perfect your deck and story

See practical examples of how to turn a decent pitch deck into a compelling story that investors care about.

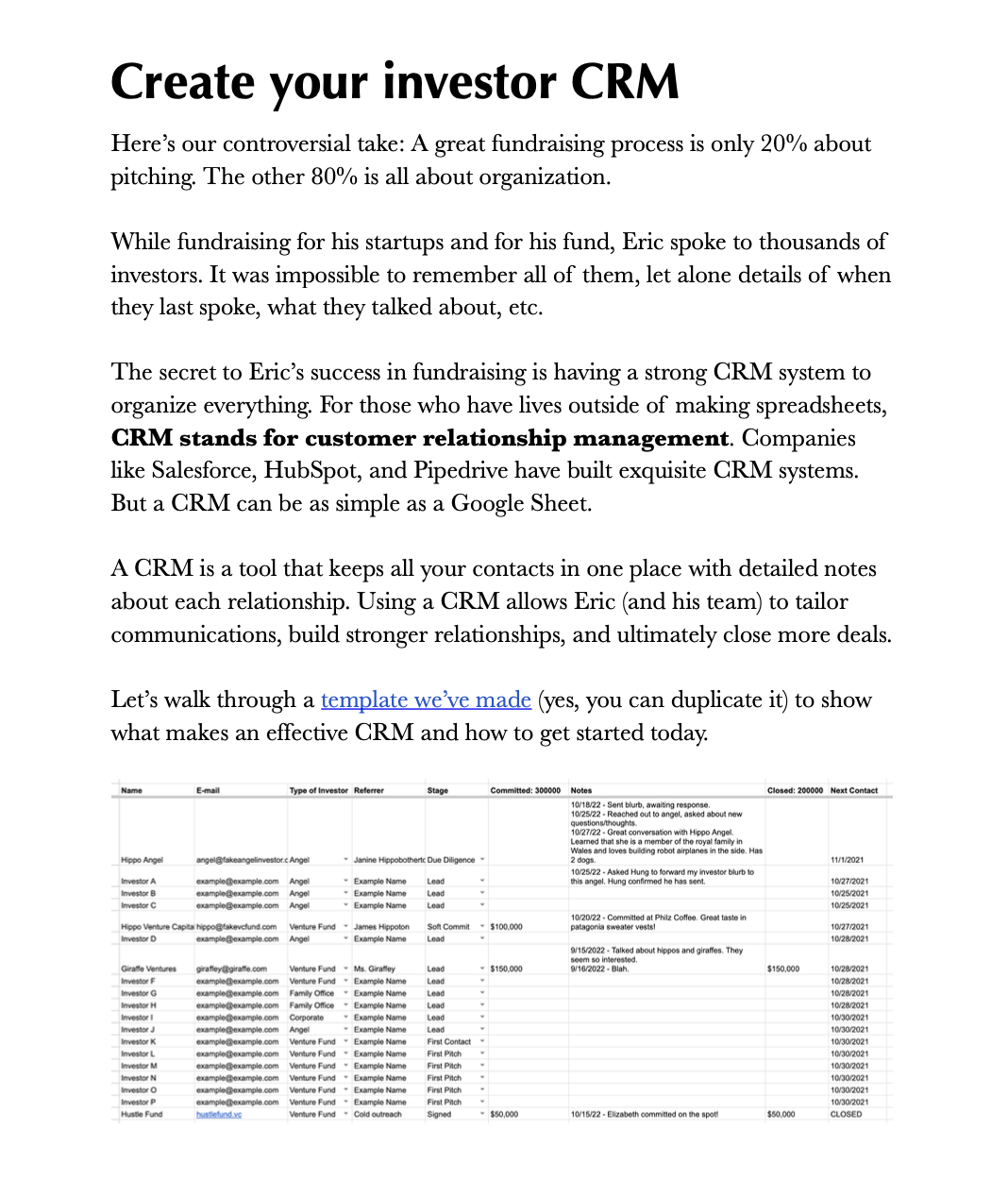

Build an investor network

Learn how to meet VCs, run your first pitch, follow up, build your investor CRM, and what to do if they say no.

Want the fundraising guide?

Just fill out the form below and we'll send it straight to your inbox.

Dive deep into what makes 5-star deck

Learn how to position your startup's:

- mission

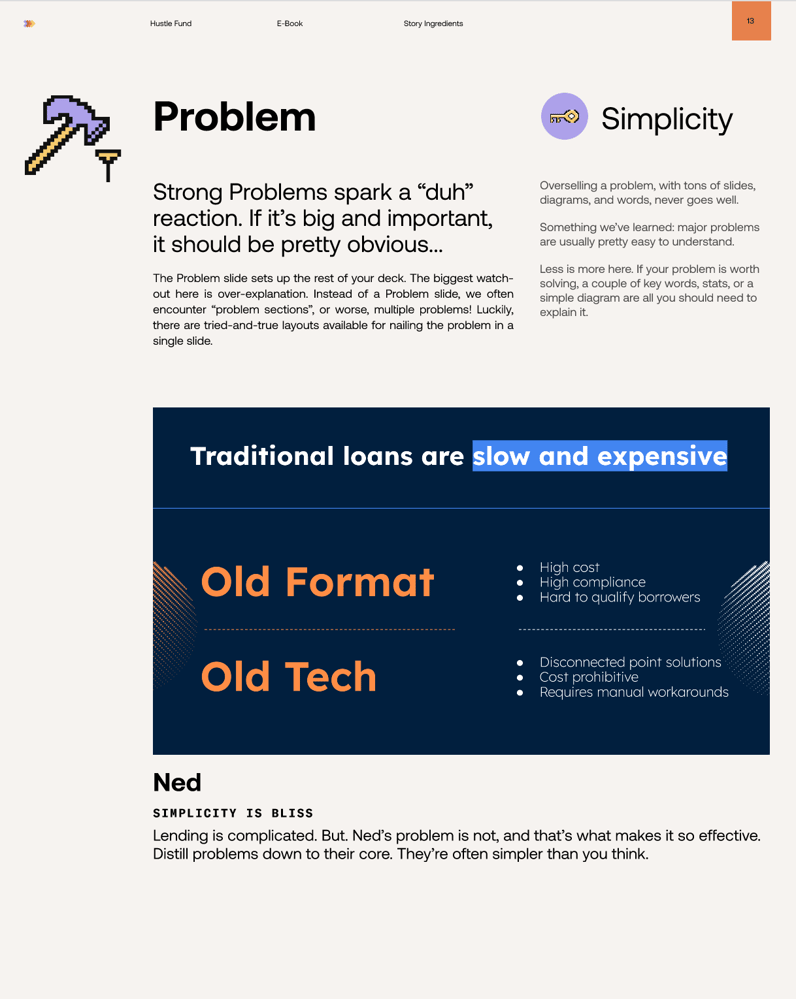

- problem

- solution

- one-liner

- market opportunity

- team

- and more

Get in front of the problem

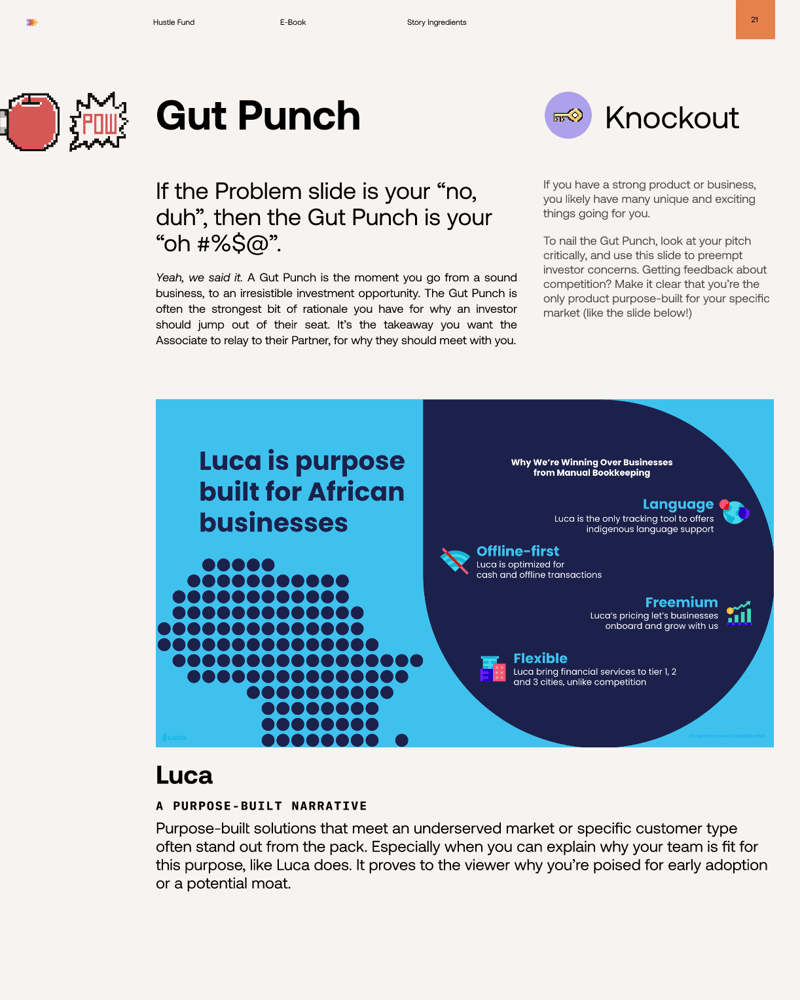

Your pitch deck can – and should – address investors' concerns, proving that investing in your startup is a no-brainer.

We show you how to do this step-by-step.

Who is Hustle Fund?

Hustle Fund is a venture capital firm that invests in pre-seed software startups. Our mission is to democratize wealth through startups by catalyzing capital, knowledge, and networks in startup ecosystems globally.

General Partners of Hustle Fund: Eric Bahn, Elizabeth Yin, and Shiyan Koh

Our team is made up of founders, operators, and investors. We’ve invested in 500 companies thanks to a deals team that reviews 1,000 pitch decks every month.

We’ve been on both sides of the table – raising money as entrepreneurs and investing in talented founders – so we know a thing or two about raising capital.